The Quantum Profile TIO Indicator is a potent analytical tool that makes use of the fundamentals of the traditional Market Profile to describe the dynamics of price behavior across time. For many traders in a variety of sectors, including Forex, equities, and binary options, it has evolved into a crucial instrument. This indicator’s primary job is to locate and emphasize important price levels, the value area, and the control value for a particular trading session.

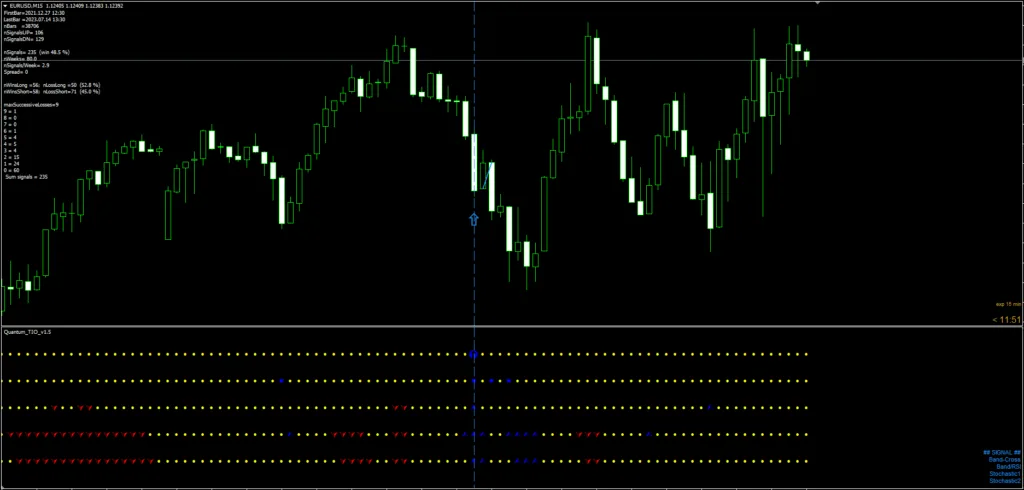

The indicator is quite adaptable and can be connected to timeframes from M1 to D1. The ability to examine market profiles for daily, weekly, monthly, and even intraday sessions is provided to traders. The trader’s needs and plan choose the timeframe to use. Lower timeframes provide more accuracy, which makes them appropriate for making short-term trading judgments. Higher timeframes, on the other hand, offer better visibility and are hence suggested for long-term trading methods.

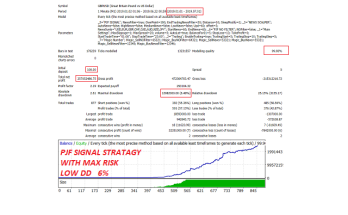

The Quantum TIO Indicator has established itself as a highly successful method for spotting pullbacks that occur after powerful impulses, independent of any technical qualities. This qualifies it for a variety of trading kinds, including binary options, stocks, and forex.

This Quantum Profile TIO can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

This Quantum TIO Indicator is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

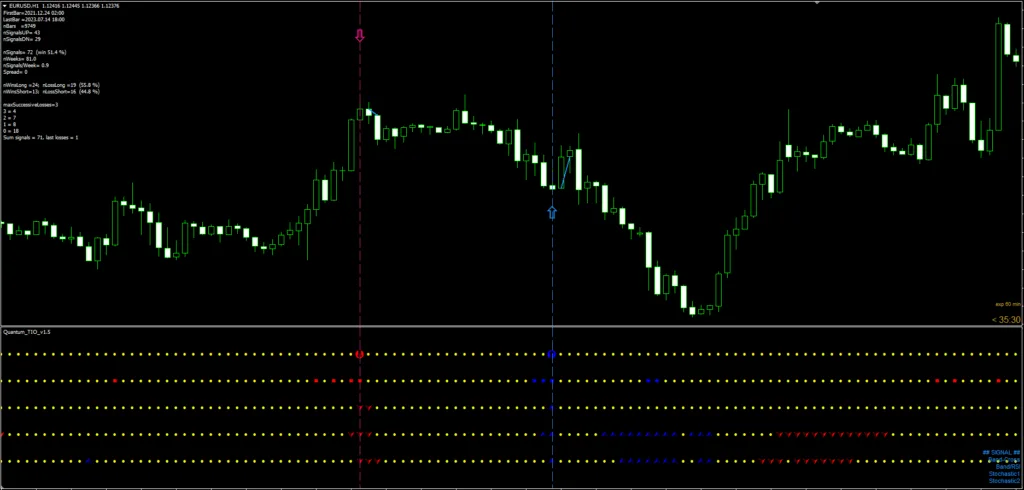

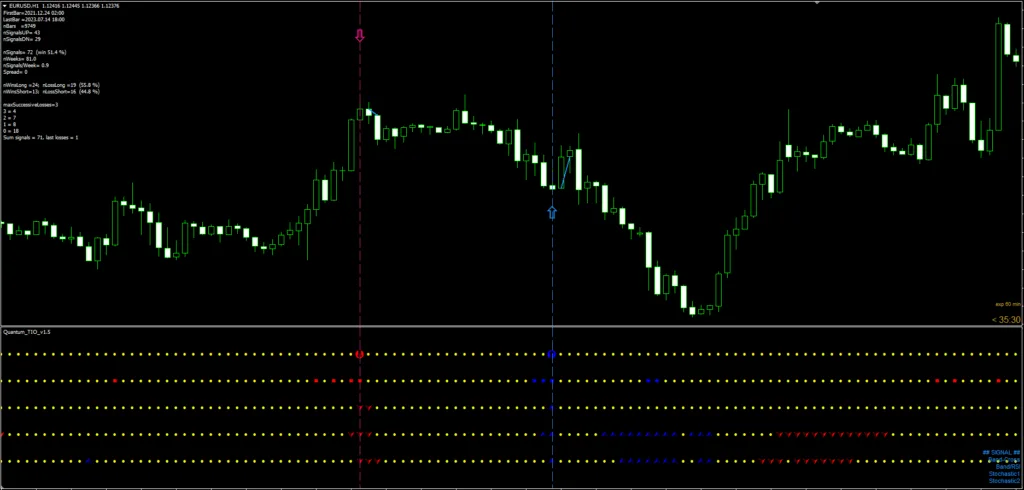

Main Chart of the Quantum Profile TIO Indicator

Trading Rules for Quantum TIO Indicator

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using this Quantum TIO Indicator.

With its various color-coded representations and notifications, the Quantum Profile TIO Indicator system provides traders with clear signals for making trade decisions. Here are the specific trading rules for using this system effectively:

1. Identifying Trade Entry Points

In the Quantum Profile TIO Indicator system, the five yellow lines play a crucial role. These lines can turn either red or blue, signaling a potential trading opportunity. When all five yellow lines turn red or blue simultaneously, the system generates a corresponding red or blue arrow with a vertical line of the same color.

This signal typically occurs at the close of a candle, and you will receive a notification when it happens. This indicates that it’s time to open a trade. For instance, a blue arrow suggests a bullish market condition, prompting a buy trade, whereas a red arrow suggests a bearish market condition, prompting a sell trade.

2. Setting Stop-Loss (SL) and Take-Profit (TP) Points

Unlike many trading systems, the Quantum TIO Indicator system does not incorporate fixed stop-loss or take-profit levels. Instead, it relies on the movement and behavior of individual candles. This unique approach provides greater flexibility but also requires the trader to be highly attentive to market conditions and price action.

3. Closing the Trade

The system provides a straightforward rule for closing an open trade. Once a trade has been initiated based on the aforementioned signal, it should remain open until the close of the current candle. When the candle closes, it is time to close the trade, irrespective of profit or loss. This rule ensures that you don’t hold your positions longer than the duration of the signal candle, reducing potential exposure to adverse market movements.

By adhering to these trading rules, Quantum Profile TIO Indicator system users can effectively monitor the markets and make informed trading decisions based on distinct, easy-to-interpret signals. As with any trading system, practicing proper risk management and conducting thorough back-testing before implementing these rules in a live trading environment is essential.